Contextmapping for Young Money

Introduction

Discovering information from end-users is important for leading new product and service. Contextmapping Skill is one of generative design method that underly needs, motivations and dreams from users.

Research revealed that people in the Netherlands have high brand stickiness to their first bank account. Therefore, the youngsters aged 13-18 have great potentials for being prospective customers for our client ABN AMRO Bank. Tutored by design agency Muzus, we helped our client to explore what are the needs and wishes of the youngsters and what are the triggers of spending/earning money in daily life.

Challenge

How can ABN AMRO best approach youngsters and engage them in banking service.

Solution

Delivering the youngsters' attitudes toward money through tangible deliverables like personas, wallets and life journeys for ABN AMRO bank to initiate their first approach to teens.

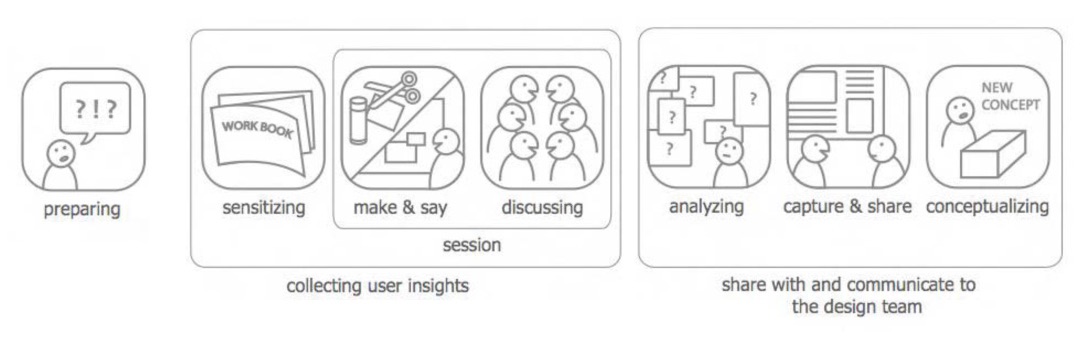

Process

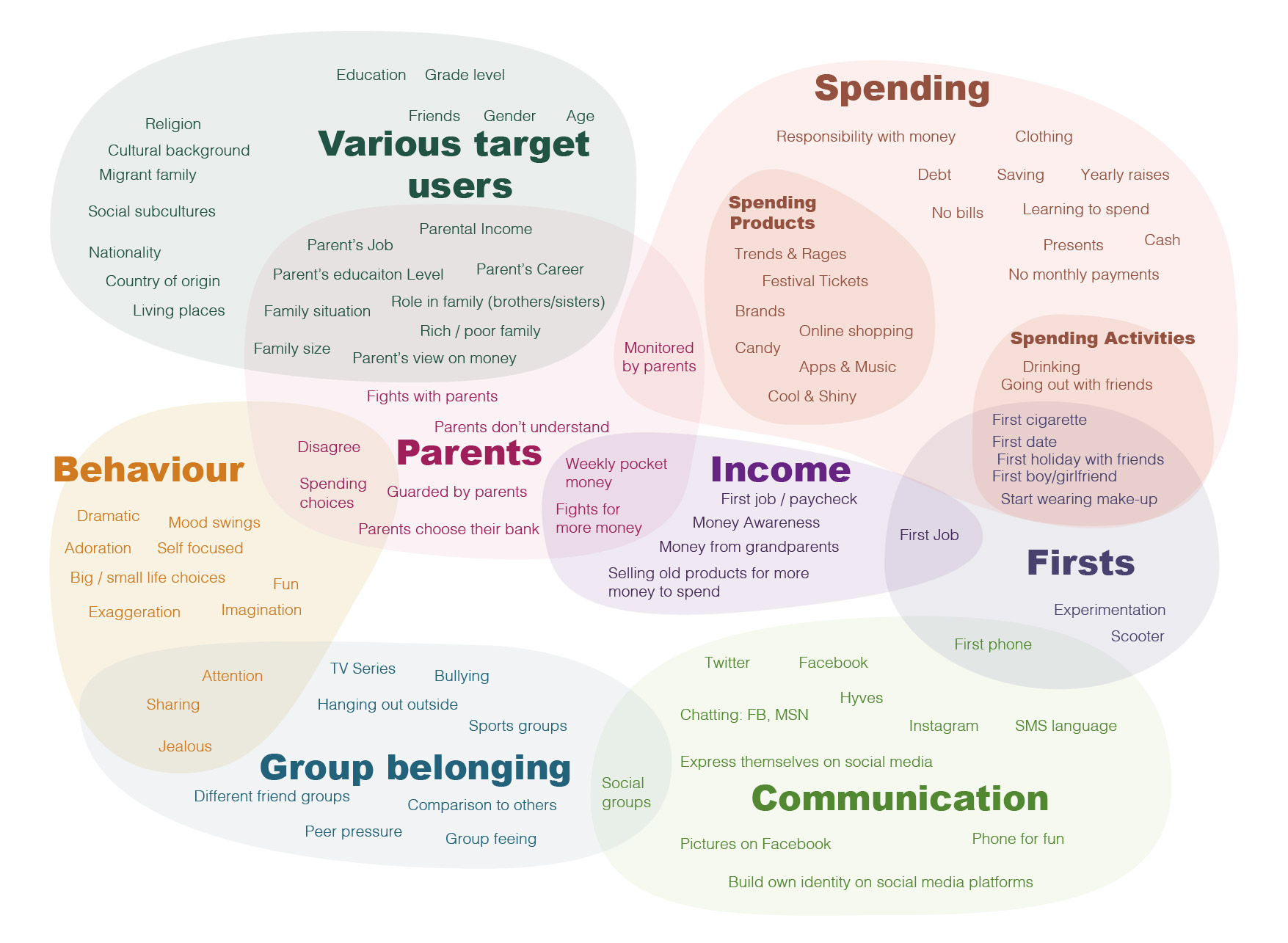

1. Assumption Map

In the preparation phase, we created a Assumption Map of our thought on teenagers by brainstorming. Topics like families, behaviours, social connections and spending helped us to formulate an image of user groups.

2. Participant Recruitment

Next, we searched teenagers who fit the profile from the teams' personal network. Eight youngsters from diverse backgrounds and education levels at age 13-16 were recruited.

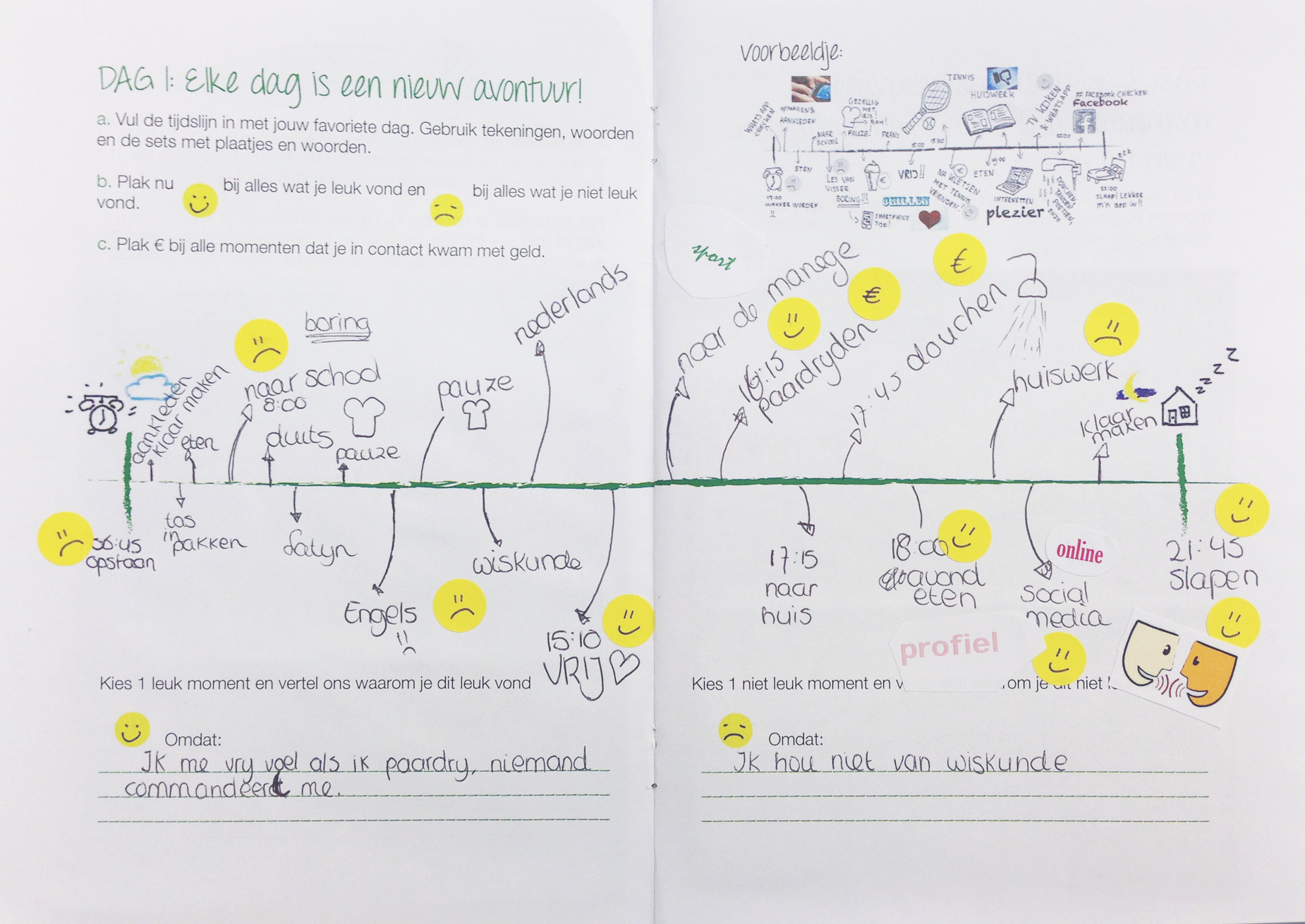

3. Sensitising Process

All participants received a sensitising package consisted of a workbook, pencils, stickers and chocolate coins. A workbook with daily assignment were well conceived by us to make participants be aware of the experience related to topics before session and enhanced the contribution they make in session. These assignments were Timeline of a day (Day1), key moments in life (Day2) (e.g. first part-time job), Close relatives & peers (Day3), Activities online/offline (Day4), Banking touch points (Day5) and Imaging future (Day6).

4. Generative Session

A 3-hour generative session was held to gain insights.

Icebreaker: Participants received chocolate coins, and were asked to ‘spend’ money to hanging envelopes that represents various spending categories. It was clearly seen that the youngsters spent pocket money mainly on food and clothings.

Timeline: The youngsters were asked to visualise 1 to 3 key moments from sensitising booklet. These moments were placed on a timeline, and defined by people, place and moment itself. Sports, hobbies, holidays and ‘first time’ experience were mostly marked. Those moments were shared with family/friends and paid by parents/grandparents. Money seems invisible for participants.

Ideal banking: To realise their ideal banking service, participants were asked to build a prototype to demonstrate ideas. The tangible output will provide the design direction for ABN AMRO bank. However, the needs addressed by teens like checking account balance, saving for sports/hobbies and keeping money safe were already offered by ABN AMRO banking service.

5. Analysis

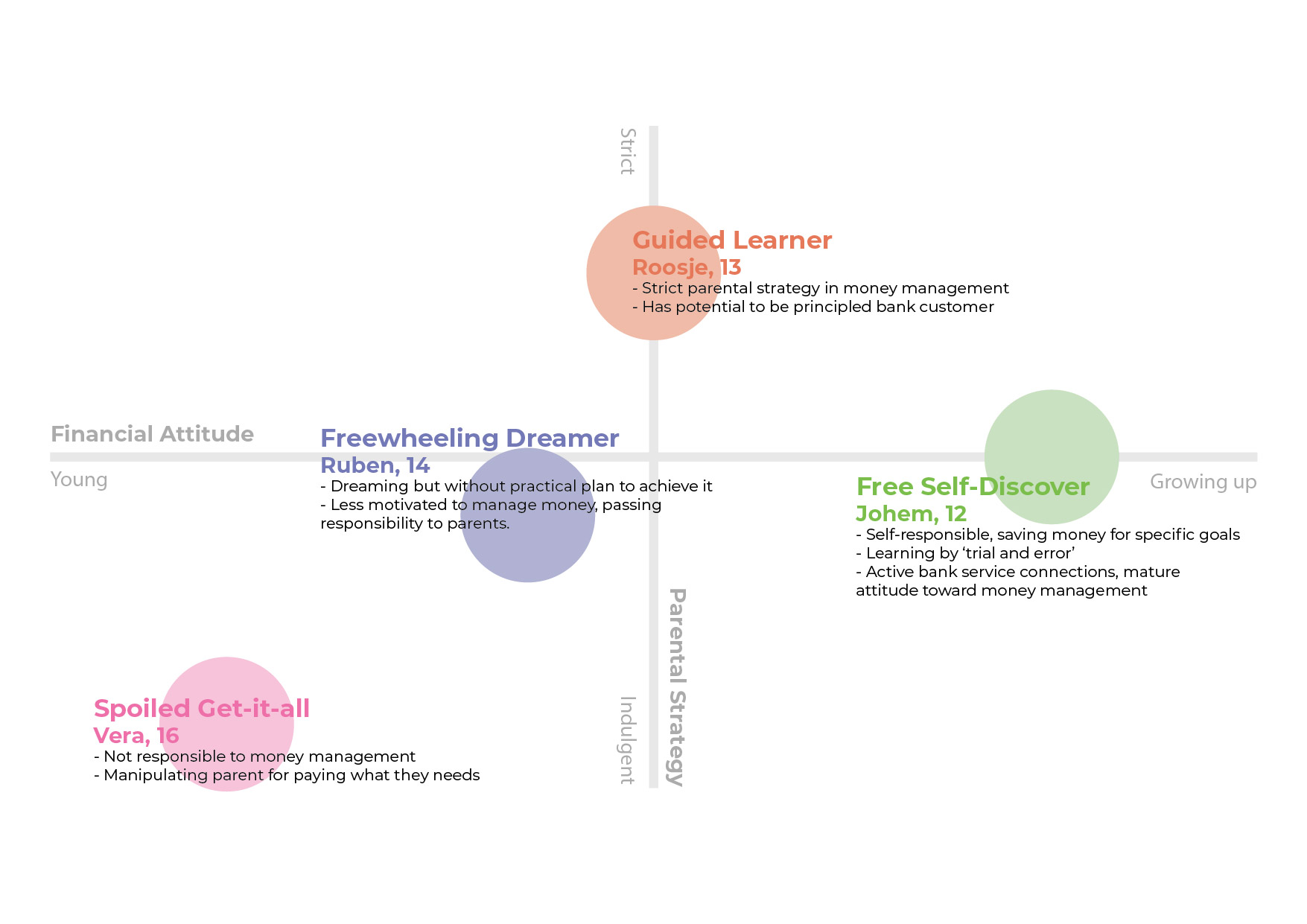

The dialogues from session were transcribed and clustered into themes like parental strategy, financial attitude, bank touchpoint, etc.

The persona grid mapped out the relevant differences between youngsters in relation to financial attitudes and parental strategy were created to form 4 persona groups from 8 participants

We also created wallets as tangible deliverables to provide rich content related to persona’s personality.

6. Communication

A internal session was held to make our ABN AMRO client be more familiar with our research result. Personas, wallets and life journeys were given as materials for brainstorming, answering the ideal moments, appropriate media and suggested activity to engage the youngsters with banking service.

This project is partnered with ABN AMRO Bank, TU Delft & MUZUS.